Stamp Duty Holiday Announced

On the 8th July 2020, the Chancellor, Rishi Sunak, confirmed that the stamp duty threshold would rise from £125,000 to £500,00 until 31st March 2021.

The so called ‘stamp duty holiday’ will apply to both residential buyers and property investors.

The government hopes that the change will help the property market to recover from the slump created by Covid-19.

Additional stamp duty has been payable for 2nd homes and buy to let properties since April 2016.

The special rules for first time buyers are replaced by the reduced rates from 8 July 2020 to 31 March 2021.

Full details of the new rates can be found here.

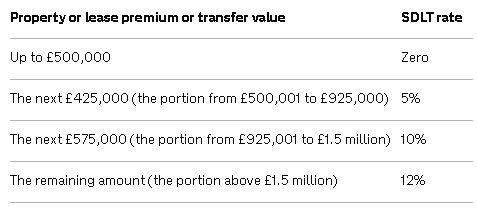

Standard stamp duty rates

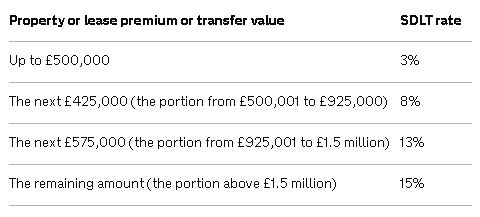

Additional property stamp duty rates

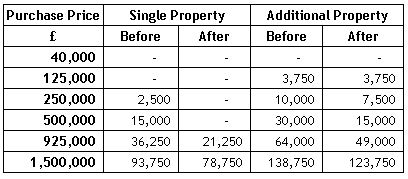

Example calculations

The following table provide examples of the differences in stamp duty which will be payable.

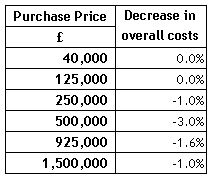

Cost reductions – Buy to let property transactions

The weighted nature of the stamp duty holiday show mean that most significant decrease in overall costs apply for properties purchased at £500,000.