Landlord tax changes begin to take effect this April

What the landlord tax changes mean for you

When George Osborne made his proclamations about changing tax relief for landlords in 2015, April 2017 seemed a long way off. While George has fallen by the wayside, the new chancellor Philip Hammond has decided to continue with the policy.

Good news for landlords is that it doesn’t affect anyone whose properties are held in a limited company. There’s also a four year roll out period, which gives any landlord that is adversely affected plenty of time to make necessary changes.

Initial changes take effect on 6th April 2017 and despite a spirited attempt by landlord groups to overturn the legislation, Section 24 of the Finance Act 2015, is becoming a reality; albeit very slowly.

At its heart, this is a system that is taxing people on their turnover not profit, which the Residential Landlords Association and our Sales Development Manager, Stephen Haigh, are keen to point out makes it virtually unique in the Western world.

This means that the press has been very eager to spread some good, old fashioned gloom on the situation, with journalists happily describing situations where landlords could have their incomes wiped out by 2020.

Meanwhile, the Government is saying the real impact will be that only one in five landlords will see any reduction in the amount of tax they actually pay.

In fact, the government are stating that:

“This measure could marginally reduce demand for housing but it is not expected to have a significant impact on either house prices or rent levels due to the small overall proportion of the housing market affected and the offsetting impact of wider budget measures. The costing includes a behavioural response from the impacted population having relief for finance costs restricted to the basic rate of Income Tax.”

So what do the tax changes actually mean and what are the implications? I’ve put together a brief guide that will help our landlords get to the bottom of the new changes.

What are the tax changes?

The 2015 Finance Act restricts the relief that landlords are able to claim on residential properties. This means that you will no longer be able to deduct financial costs, such as mortgage interest, from income derived from that property, in order to calculate the sum of money you will taxed on.

Instead, you will receive a basic rate reduction of 20% from your income tax liability.

Previously, mortgage interest was included as an ‘allowable expense’, alongside other costs such as insurance, property repairs and professional fees. Landlords who paid higher rates of tax could also claim tax relief at their higher rate. This has now been capped so that, no matter what your tax band, relief is calculated at the basic 20%.

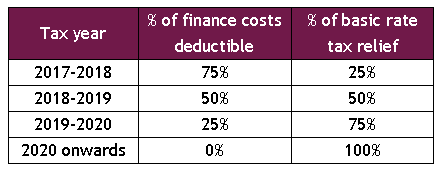

The changes will be introduced gradually from 6th April, with the full changes coming into effect by 2020.

The finance costs that will be restricted include interest on:

- Mortgages

- Loans, including those to buy furniture

- Overdrafts

- Alternative finance returns

- Fees and other incidental costs of getting and repaying loans and mortgages

- Discounts, premiums and disguised interest

Some examples of how the landlord tax changes might effect you

On its website, the Government gives several case studies that show, in reality, tax bills aren’t going to lunge upwards.

Note: all the Government figures are worked out with the following income tax brackets:

- Personal Allowance – up to £11,000

- Basic rate 20%: £11,001 to £43,000

- Higher rate 40%: £43,001 to £150,000

Basic rate of tax – no change

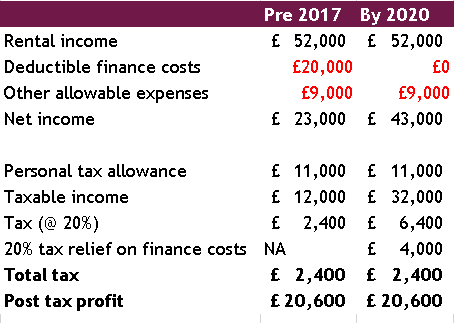

Landlord 1 has a yearly rental income of £52,000. It is their only source of income. They are paying mortgage interest of £20,000 a year.

So, if your only source of income is through your rental yields and you only pay basic tax rate, relax.

Of course, many landlords do derive income from other sources.

Basic rate of tax – change in tax

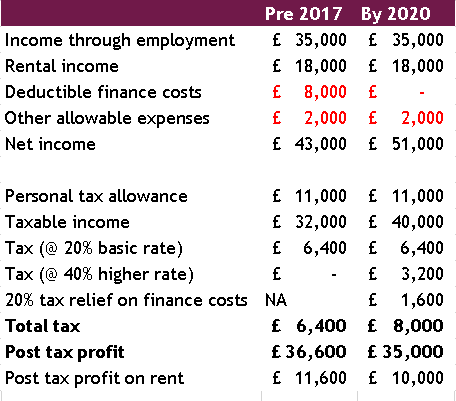

Landlord 2 receives an additional income of £35,000 from a job. Their rental income is £18,000 a year and mortgage interest of £8,000 per year.

The change in how tax is calculated means that this landlord suddenly finds themselves in a higher tax band and paying an additional £1,600 in tax. The government does also mention that, if you are claiming benefits such as Working Tax Credit, this move to a higher tax bracket could also affect these payments.

Here, I’ve quickly replicated two of the case studies, to give you a flavour. There’s more information on that Government’s own website.

This is course raises the question ‘what about landlords who are already paying tax in the higher bracket?

Higher rate of tax

Simply put, whereas before, tax relief could be claimed at this higher level, the new tax laws mean that reductions will be capped at the basic rate of 20%.

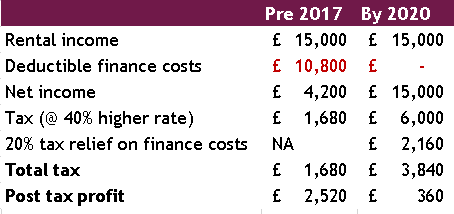

This is where the potential big losses are. While the government is confident that all landlords will fall somewhere within the bounds of the two case studies above, others have been quick to point out that by 2020, landlords who already pay 40% tax could be experiencing something akin to:

Obviously this is a much blunter calculation than the Government’s, but it’s clear that the increased tax on this property slashes profits to practically nil. Any significant maintenance issues, or even a paint job, would gobble up the 2020 profit here.

If the Government’s vaunted rationale for making this change is to make the rental market fairer for those who rent, What Mortgage’s survey of landlords, suggests it might have the opposite effect, with just under a quarter of landlords saying they will consider raising rent to meet these increased costs.

Other possible solutions have also been put forward.

Cash

At the end of 2016, reports suggested that there was a steep rise in cash buy-to-let purchases . One set of figures going so far as to suggest that across the UK 61% of these purchases were cash-only. In fact, only the London, where house prices are substantially above the rest of the country, saw purchases without a Mortgage under 50%.

In the markets where Purple Frog operates, the figure are:

- West Midlands 54%

- East Midlands 62%

- South West 67%

Mortgage lenders have also been quick to react to the change in law by offering reduced interest rates for Buy-to-Let mortgages.

While landlords with a lot of cash floating round may want to consider this option, it’s worth remembering that, while mortgage interest will play a larger part in deciding your tax affairs, by leveraging a mortgage means that part of your yield will be from money invested from elsewhere, namely the bank.

Incorporation

Of course, the changes to the tax law only affect private individuals, not incorporated companies.

This has seen a spike in the number of landlords moving to incorporating their businesses – according to a recent survey 11% of landlords had already incorporated, or moved holdings to a spouse or partner who pays a lower tax rate.

According to the report, 25% are considering following them.

That said, while bandwagons are always fun to jump on, wiser heads are pointing out simply incorporating might not be the hoped for panacea. Experts are quick to point out that landlords should give serious consideration to how money from rent will be passed from the company to the individual.

For instance, money taken from dividends is still taxable, with the rules on this having changed in April last year, so that only the first £5000 of this income is tax-free. Meanwhile, paying the money as salaries could require you to also pay PAYE and National Insurance contributions.

There is also the possibility that transferring a property from an individual to a limited company could trigger stamp duty and Capital Gains tax charges. Running the idea past your accountant is advisable, before taking the leap.

So does any of this really matter?

Yes and no.

When the new rules were announced, the Financial Times observed that the outcomes contained an amount of legerdemain. Their correspondent noted that, while officials claimed that the measures would reduce buy-to-let mortgage approvals by 10-20% over the next two years, this meant they were expecting a 17% annual increase, rather than 20%.

The cynical amongst us might be moved to comment that these changes are a nice way to be seen to be doing something about Britain’s ‘broken’ housing market, without having to actually do much at all. Except claw in some extra income tax.

Meanwhile, within the sector itself seems rather defiant. 13% of landlords are expecting to make another buy-to-let purchase this year and the conditions that have been driving the wider boom in buy-to-let remain largely unchanged, with restricted supply of new housing stock and pension reforms giving the over-55’s access to investment funds. This is at least something that the student market shares with the sector as a whole, with demand vastly outstripping supply.

As always, these wider changes in the property investment market tend to cause a few ripples through the student sector. After all, while the government’s laudable aim is to encourage more housing stock back into private ownership, student accommodation tends to be highly localised. As well as legal constraints, such as Article 4, market demand to be within strolling distance of the university means that any houses released by a student landlord are unlikely to roll over into anything other than another student rental.

The landlords most affected are more likely to own professional or family lets rather than student property, which tends to provide better returns. Returns will continue to be solid, especially for the ‘career landlord’, who derives the majority of their income from their property investments and tend to be attracted to the student market.

Though I would suggest a quick word with your accountant if you are one of the one-in-five who pay above base-rate tax. Your larger yield might necessitate joining the ranks of landlords incorporating into limited companies. Certainly, this approach would suit those who are looking at their student properties as long term investments, rather than as day-to-day income.

There’s four years before the landlord tax changes take full effect. As with so much with property investment, we shall have to wait and see.

Further reading

- https://www.gov.uk/government/news/changes-to-tax-relief-for-residential-landlords

- https://www.gov.uk/government/publications/restricting-finance-cost-relief-for-individual-landlords/restricting-finance-cost-relief-for-individual-landlords

- https://www.gov.uk/guidance/changes-to-tax-relief-for-residential-landlords-how-its-worked-out-including-case-studies